Estimated tax payment calculator 2021

For income received April 1 through May 31 estimated tax is due June 15 2022. The provided calculations do not constitute financial tax or legal advice.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Use this tool to.

. The IRS Can be Very Reasonable if You Know How They Work. Generally you must make estimated tax payments if in 2022 you expect to owe at least. Ad Try Our Free And Simple Tax Refund Calculator.

No More Guessing On Your Tax Refund. 1040 Tax Estimation Calculator for 2021 Taxes. 100 Accurate Calculations Guaranteed.

Based on your projected tax withholding for the. How Income Taxes Are Calculated. Estimate your federal income tax withholding.

If you expect to owe more than 1000 in taxes thats earning roughly 5000 in self-employment income then you are required to pay estimated taxes. Normally the 153 rate is split half-and-half. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

See how your refund take-home pay or tax due are affected by withholding amount. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self. Based on your projected tax withholding for the year we can also estimate your tax refund or.

How Income Taxes Are Calculated. See How We Can Help. Most individuals and businesses in the United.

250 if marriedRDP filing separately. Crediting an overpayment on your. To calculate your estimated taxes you will add up your total tax liability for the current yearincluding self-employment tax individual income tax and any other taxesand divide.

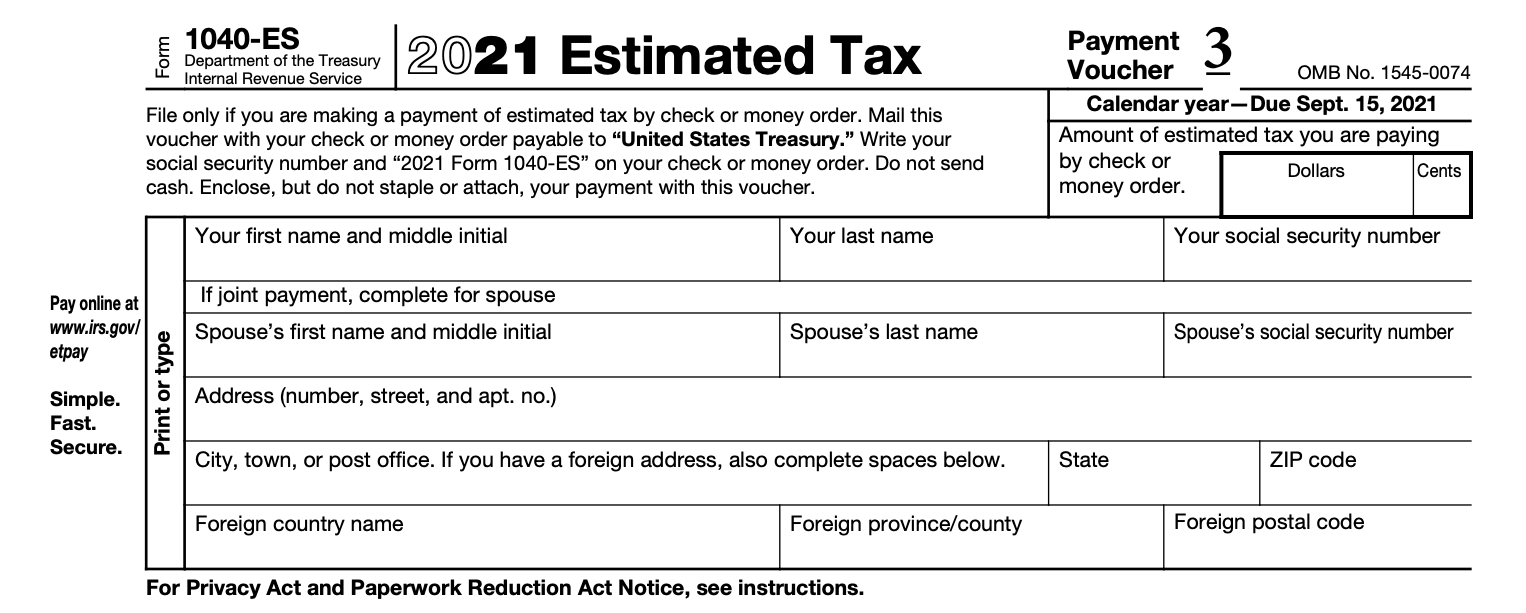

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. As a partner you can pay the estimated tax by.

The combined tax rate is 153. Enter your filing status income deductions and credits and we will estimate your total taxes. Calculator Guide A Guide To The 1040 Tax Form Frequent Tax Questions.

And you expect your withholding and credits to be less. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Due to federally declared disaster in 2017 andor 2018 the.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. This saves you from having to submit payments yourself.

Use Form 1040-ES to figure and pay your estimated tax for 2022. This simple calculator can help you. For example if the results from this calculator tell you to pay 1200 quarterly have your employer increase your withholding by.

Ad We Can Help if You Owe Tax. Use this federal income tax calculator to estimate your federal tax bill. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Enter your filing status income deductions and credits and we will estimate your total taxes. As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. Estimate Today With The TurboTax Free Calculator.

Click the following link to access our 2021 income tax calculator. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Quarterly Tax Calculator Calculate Estimated Taxes

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

50 Free Excel Templates To Make Your Life Easier Updated August 2021 Excel Templates Budget Planner Template Personal Budget Template

Quarterly Tax Calculator Calculate Estimated Taxes

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Utah Paycheck Calculator Smartasset Director De Arte Agencia Publicitaria Disenos De Unas